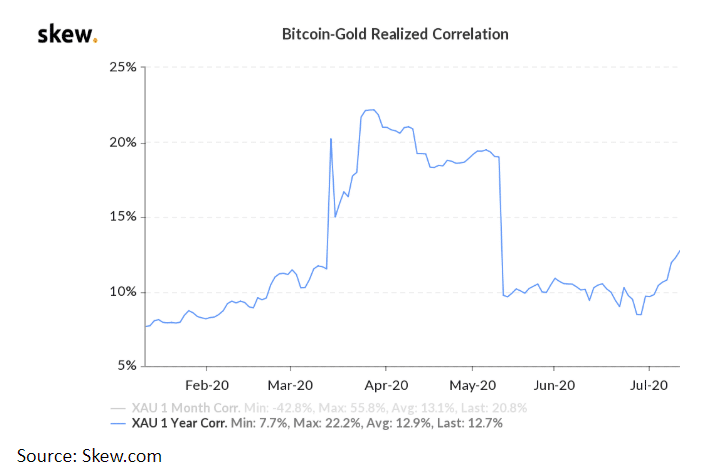

Once governments start to implement the necessary measures to pay back their colossal coronavirus relief debts, rising inflation and bearish stocks could see investors start to seek more opportunities to hedge their losses. One asset class that has never had to weather a global economic recession is cryptocurrencies. Bitcoin was born out of the last global financial crisis in 2008/2009, so this will be the first time digital assets have been tested in a broader bear market. The global downturn also comes at a particularly intriguing time in the ongoing maturity of cryptocurrencies. For many years, Bitcoin had a reputation as being the currency of shady transactions on the dark web. However, reputable institutions such as the CME are now offering cryptocurrency-backed derivatives. In 2019, Fairfax County’s Retirement Systems, in Virginia, became the first U.S. Pension fund to invest in digital assets. Furthermore, during March, when the stock market was falling, Bitcoin’s correlation with gold shot up.

As the stock markets stabilized, the correlation appeared to subside. However, the pattern indicates that during periods of wider economic volatility, Bitcoin could prove to be more of a reliable hedging asset than many people would have thought.

Breaking Down Barriers to Entry

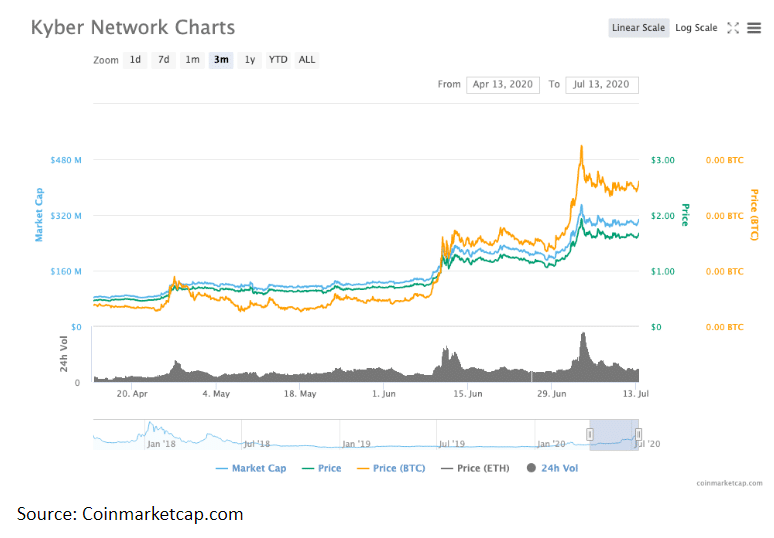

For the average retail user, getting involved with crypto can be a daunting prospect. Even despite the progress made in the reputation of digital assets, cryptocurrency exchanges still have a lot of work to do following several high-profile hacks and exit scams. However, thanks to the cleaner reputation of the broader cryptocurrency sector, there are now several reputable companies offering the opportunity to get into crypto without having to go via an exchange. Skrill is one such company, an established player in the payments industry that has expanded into offering a suite of digital asset services. Anyone with a Skrill account can buy, sell, or exchange a range of cryptocurrencies easily and securely. Users can also take advantage of built-in tools to help them manage their investments. For example, Skrill offers the ability to set up recurring orders, enabling lower-cost investing in the long-term and offsetting some of the volatility risks. Skrill offers access to a variety of different cryptos, which provides further opportunities for investors not just to hedge against losses in traditional investments, but also to profit from price increases. Cryptocurrencies have the potential to buck broader market trends, mainly if there’s something notable happening around any given project. For example, Ethereum looks set to implement the first phase of a major upgrade to the platform this year, which will involve implementing a new consensus model called proof of stake. Without going into any technical detail about what this means, the new model will involve staking tokens, which means locking them up for a given period. Analysts are speculating that this shift to the new model will result in a price increase due to a squeeze on supply. Similar patterns are also observable in other assets. For example, Kyber Network (KNC), which was also recently added to Skrill, has undergone a launch of its own decentralized autonomous organization, conferring governance and voting rights on token holders and leading to a buying frenzy. Similar to Ethereum, this has put a choke on circulating supply, pushing up demand, and also the price.

Wrapping It Up

While the coronavirus continues to wreak havoc across the globe, stagnation seems like the best-case scenario for most markets. Gold is the most traditional hedging tool, but investing in gold also comes with its own challenges. Therefore, it seems possible, or even likely, that cryptocurrencies could prove to be an attractive outlet for everyday investors seeking out hedging opportunities or even the chance of making gains. Now that Bitcoin has shaken off its reputation of five years ago, and it’s easier than ever to get your hands on a range of cryptos, it seems that the time is ripe for digital assets to start going more mainstream.